Written by Ophir Gottlieb

PrefaceNike (NKE) crushed earnings, broke out to an all-time high, had its single best day for the stock in a decade �� but all of that, all those headlines, fail to capture the bullish narrative that came out of the results.

We added Nike to Top Picks on 2-Jan-16 for $61.36. As of this writing the stock closed at $79.68, up 30%.

In our most recent dossier on the company from 3-30-2018, we noted that not only was the tide turning, but that tide was multi-faceted.

That is to say, it wasn��t one region, one product or one part of technology that was working, it appeared that all of it was starting to work, and what we learned last week was the empirical data that was suggested by that circumstantial evidence in March.

As you read through the story note that Nike is now a full-blown apparel company (over $10 billion in apparel sales), has an explosive women��s focused business line, has incomparable social media success for discretionary products, and a booming personalized technology presence.

StoryBefore we get to the actual numbers �� that is revenue and earnings per share, we can start with a broader view of the company. Nike has a plan that they have termed ��triple double,�� which is a doubling of innovation, a doubling of speed, and a doubling of digital.

This is referred to as Consumer Direct Offense.

* To double the cadence and impact of innovation, the Company will lead with more distinct platforms and scale innovation faster, will edit-to-amplify to give consumers better choices and will create new aesthetics spanning both sport and style.

* To double speed to market by reducing the average product creation timeline by over 50 percent through investments in end-to-end digital capabilities to serve consumers faster.

* To double direct connections with consumers and shape the future of retail led by Nike.com and all new owned and partnered NIKE Consumer Experiences.

In this last earnings release and call we learned about growth coming from, essentially, everywhere. The Nike Air platform, like Vapor Max, is growing, Nike Retro is growing, Nike��s new products are growing, its cushioning platform, which has four significant outsole technologies (like Nike react) is growing, and even Jordan brand (which was weak) is, according to the company, at an inflection point.

Barclays bank claims its channel checks show 30% or greater growth in the Jordan brand, year-over-year in select Jordan brands. This is not just footwear but also apparel.

Nike grew revenue 35% in China and 24% in the region that includes Europe, the Middle East and Africa.

Nike��s largest region, North America, broke its streak of shrinking revenue and the company was emphatic that this was the new trend. Sales in the region improved 3.3% year-over-year, beating analyst expectations of a 0.98% rise.

That North American growth was attributed, at least in part to new products and technology �� specifically the smartphone app.

Even further, if you listen to the earnings call, which we will cover below, according to Nike, this is only the beginning of growth, it could get better and persist longer. The company, in fact, raised its annual sales growth forecast to the high single digits, as opposed to a previous estimate for growth in the mid- to high single-digits.

Let��s look at the actual earnings results, then the critical parts of the earnings all.

Earnings Results* Revenue: $9.79 billion, 12.8% growth, versus analyst expectations of $9.41 billion.

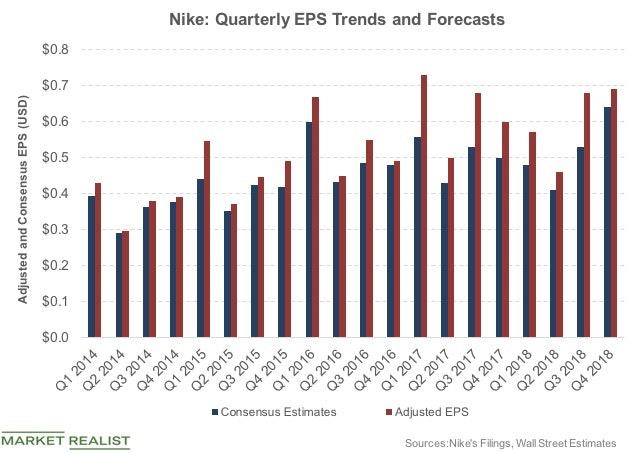

* EPS: $0.69, 15% growth, versus analyst expectations of $0.64.

It's worth noting that Nike has a long history of beating consensus estimates for EPS.

The company also announced a $15 billion share repurchase program.

Earnings CallHere are the critical elements we wanted to share from the earnings call. Our emphasis is added.

* [W]e��re so excited about potential of the Consumer Direct Offense. [They] are igniting the next phase of growth and profitability for NIKE.

* We��re winning with new innovation.

* New innovation platforms will drive over 50% of our incremental growth over the next five years. In fiscal year ��18, revenue from new innovative platforms actually drove over 80% of our incremental growth.

* We��re leading with platforms, not just products. For example, React and Air Max are scaling through multiple styles and across categories. They��re driving extraordinary growth and brand heat with consumers.

* Sportswear, a $10 billion business for NIKE had another quarter of double-digit growth.

* In Sportswear, the consumer demand for all-day comfort is making Air Max one of the fastest growing platforms in our industry.

* NIKE Digital was up 41% for the quarter.

* Overall, running grew 7% for fiscal year ��18. And with the loaded pipeline in fiscal ��19, [] we see a great runway ahead for our largest performance category.

* The success of our new cushioning platforms is driving momentum in our women��s business as well.

* One of our biggest opportunities for fiscal ��19 is to scale our women��s sneaker business across both NIKE and Jordan. In women��s apparel, lifestyle is also leading the way, highlighted by strong growth in tops and fleece.

* This quarter, we nearly tripled the size of Jordan��s women��s sneaker business.

* Jordan apparel was up double digits in all geos, and the Jordan Brand in China was up nearly 50%. These are the areas where we see exponential growth and we��ll continue to focus.

And, as is required for any successful company today, digital isn��t ��a category,�� it��s the business.

Digital is allowing us to realize our vision for smart retail to remove friction and personalize experiences through the intersection of digital and physical environments.

It��s sharpening our ability to sense the market through data and analytics. It��s unlocking new manufacturing tools that are more precise and drive a new esthetic. And it��s opening up opportunities for new partnerships and how we develop talent in the organization.

* Our investments in the digital experience are also creating a platform for new brand-friendly e-commerce partnerships.

* And we see huge potential emerging storytelling and shopping through our social platforms.

ConclusionNike crushed earnings, again, and this time the company did follow through with higher than expected North American sales growth and international growth.

It��s selling shoes and apparel. It��s selling platforms and innovating. It��s selling to women and men, internationally and domestically. It has multiple product lines that are in the top 3, if not all of the top 3, in certain categories at price points above $125.

Its innovation is working. Its digital strategy is working. Its technology has allowed to reduce the average product creation timeline by over 50%.

Its innovation has had a huge impact on direct connections with consumers led by Nike.com and all new owned and partnered NIKE Consumer Experiences.

Nike is at decade high valuations right now, but if we look out 5-10 years, with the impeccable precision on which it is executing in every aspect of its business, we see more to come.

And, yes, the market will drop at some point, and yes there will be a recession too. But Nike has a plan �� it��s working, and we believe it will continue to work, even with rather large bumps in the road.

Thanks for reading, friends.

Disclosure: I am/we are long NKE.

No comments:

Post a Comment